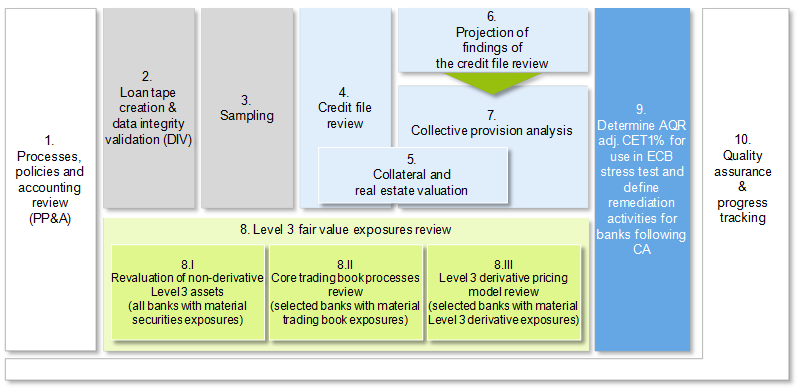

The AQR can be seen as the first step of the 2014 stress test, as in previous years audited financial statements were used as the basis for the calculation of the capital ratio – the “stressed item”. This year, the audited capital ratio as of 31.12.2013 has been adjusted based on an asset due diligence that also accounts for the CRR/CRD IV and IFRS implementation impact. Since the asset due diligence is performed on harmonized methods drafted by the ECB, it inevitably leads to higher deductions from capital (e.g. higher impairments, fair value adjustments to level 3 assets, correction of non-CRR compliant calculation of capital). The Asset Quality Review manual, published in March 2014 on the ECB homepage, sets the focus of the exercise on the following topics:

- Review of policies and their implementation under consideration of compliance with regulations

- Asset Quality Review of credit files under consideration of adequate collateral valuation

- Review of the appropriateness of the collective provisioning approach and

- Review of the valuation of level 3 assets.

In detail, these main areas of focus resulted in the following working blocks:

The adjusted Common Equity Tier 1 (CET 1), Block 9 in the figure above, should be finalized by August 1st 2014, setting the planned deadline for the Asset Quality Review in 2014.

Although there are no final results at the point of publication of this article and bank specific issues have to be kept confidential, there are certain issues that all banks seem to be struggling with:

- Lack of data quality and difficulties in quickly accessing consolidated data

- Unfinished implementation of CRDIV/CRR as of 31.12.2013 in connection to the calculation of Common Equity Tier 1

- Lack of resources to handle the high burden of regulation

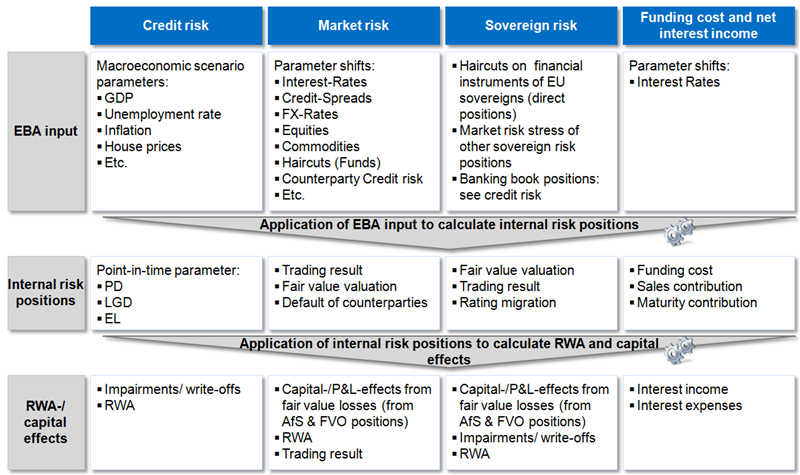

The ECB stress test is designed to focus on four dimensions: credit risk, market risk, sovereign risk and net interest income (funding cost and interest income). For each dimension, the EBA provides methodological guidelines and scenario parameters. Finally the effects of the stressed parameters on the CET1-ratio have to be calculated.

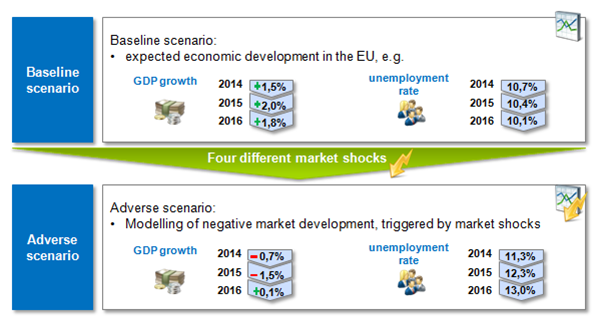

The scenarios have been developed by the national competent authorities (NCA), the European Commission, the European Systematic Risk Board (ESRB), and the ECB. The banks have to project their positions in a baseline scenario and an adverse scenario for the years 2014-2016 using the framework provided by the EBA. Both scenarios use the static balance sheet assumption, i.e. the volumes of 31.12.2013 are held constant for the whole projection period and maturing positions need to be replaced by similar financial instruments in terms of type, credit quality at date of maturity and residual maturity as at the start of the stress test. The baseline scenario reflects the expected economic development in the EU according to the common opinion of the above stated organizations. The adverse scenario models a severly negative macroeconomic development. Triggered by a capital markets shock in which bond yields increase as well as interest rates, credit spreads and FX volatilities, this scenario also includes macroeconomic indicators such as GDP growth, unemployment rates, property prices as well as default rates deteriorating.

The stress test results in all four dimensions under both scenarios affect RWA and capital which ultimately determine the Common Equity Tier-1 ratio (CET1-ratio). The EBA has set minimum hurdle rates of 8% CET1 ratio for the baseline scenario and 5.5% CET1 ratio for the adverse scenario. However, the relevant NCA may set higher hurdle rates based on a ladder of intervention points arising from the stress test.

Banks have to submit their (preliminary) stress test results to the EBA in Q2 2014 (e.g. June 23 for German banks) which will subsequently conduct quality assurance, perform benchmarking and challenge the submitted results. Banks need to prepare for enquiries by the EBA, i.e. to defend assumptions and applied models (defence cases). In this phase, results from the AQR are included in the stress test assessment. Final results are expected at the end of October 2014 and will be disclosed on a bank by bank basis with a similar granularity as results of the EU-wide stress test in 2011, including the capital positions of banks, risk exposures and sovereign holdings. For banks which are not able to meet the required hurdle rates or which exhibit other breaches, an action plan to comply with the regulatory requirements will be required.Banks have to submit their (preliminary) stress test results to the EBA in Q2 2014 (e.g. June 23 for German banks) which will subsequently conduct quality assurance, perform benchmarking and challenge the submitted results. Banks need to prepare for enquiries by the EBA, i.e. to defend assumptions and applied models (defence cases). In this phase, results from the AQR are included in the stress test assessment. Final results are expected at the end of October 2014 and will be disclosed on a bank by bank basis with a similar granularity as results of the EU-wide stress test in 2011, including the capital positions of banks, risk exposures and sovereign holdings. For banks which are not able to meet the required hurdle rates or which exhibit other breaches, an action plan to comply with the regulatory requirements will be required.

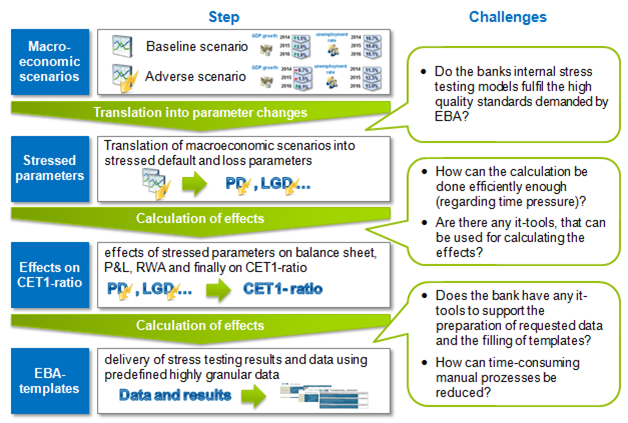

As with the last European stress test in 2011, banks are severly challenged by conducting the ECB stress test in 2014. zeb is supporting several stress test projects at European banks which all face common challenges as shown in the following figure.

As a first step banks have to translate the given macro economic senarios into parameter changes by using statistical internal models (if available). The banks‘ internal stresstesting models therefore need to fulfil high qualitative demands. Subsequently banks have to calculate the effects of stressed parameters on RWAs, balance sheet positions and P&L. Without a tool for calculating these stress test results, time can be a significant challenge. In addition, similar to the AQR a major difficulty is data availability. The EBA requires to complete given structured templates on a highly granular level which requires a considerable amount of manual work as generally multiple data sources within the bank need to be deployed. In consequence, the manual processes increase the required effort for quality assurance. Furthermore the EBA requires the use of data definitions in compliance with supervisory regulations (with regard to COREP, FINREP, CRR, CRD IV and IFRS). To provide the correct data according to the EBA definition a time-consuming coordination process with the EBA is necessary. Moreover, the banks have to employ the detailed and qualitative scenario specifications into their own simulation models which requires the development of a new or the adaption of the existing stress test methodology. The very tight schedule further increases the effort needed to conduct the EBA stresstest.

For bank management, the current ECB stress test has certain implications. Firstly, banks need to address the findings from the AQR and stress test. Remedial actions to avoid increased capital requirements and the corresponding measure tracking are at the top of the agenda. After the fire fighting, banks can focus on how to respond in the long-run. The ECB is currently planning to conduct EU-wide stress tests annually. Therefore banks need to evaluate how the ECB stress test will affect their bank-individual stress test concepts and realisations. To reduce the banks‘ very high efforts on conducting the annual ECB stress test, internal processes related to the ECB stress test need to be standardized. Especially manual processes concerning the calculation of stress testing effects, data preparation and the filling of the predefined templates should be automatad as much as possible. The EBA has set a certain benchmark with the stress test in 2014 concerning scope, qualitative assumptions, macro scenarios, time horizon and methodology. Banks should adapt these standards in their concepts in order to be prepared for possible further ECB stress tests. Furthermore, adapting the standards helps to meet the regulatory requirements concerning stress tests. It can be expected that the EBA will benchmark bank-individual stress test concepts with its own design, at least for significant banking institutions. Adapting to the EBA design also enables banks to consistently monitor the effectiveness of capital measures taken in case hurdle rates are missed. Additionally, the experienced challenges and problems during the stress test require action. Data availability needs to be improved by optimizing data quality and processes. An integrated approach is necessary to connect data with systems and processes. In view of the principles for effective risk data aggregation and risk reporting (BCBS 239), banks have two incentives to refine their data warehouses. The implementation of a proper simulation tool which allows for an integrated scenario analyses can also support the stress test process by reducing manual work (and corresponding error-rates) and process time in general. Especially for “ad hoc” stress tests, a simulation tool provides valuable support. However, a stress test tool always requires a solid data base (and data integration).

With the annual EU wide stress test, the EBA has clearly emphasized the importance of stress testing in the evaluation of a bank’s sustainability. However the goal of the stress test to provide confidence in the banking sector cannot be achieved by a single measure. The ECB stress test 2014 is a good step in providing stability and confidence for the banking sector. Assuming that this exercise reveals all existing risks and prevents future crises would be a fallacy. The stress test is a snap-shot and only a system of confidence building measures can provide stability for the banking sector.